We're Hiring!

Join one of the fastest growing real estate teams in the US and Canada. Fill out the form below and we will contact you with more info.

Request property marketing plan

You're one step away from getting a free marketing plan that shows how we'll sell your home for the most amount of money in the least amount of time - hassle free.

The Buying Process

Buyer

Consultation &

Defining Your Needs

Our goal is to build a life-long relationship with our clients. We provide value to our clients by protecting their best interests and offering exceptional service. Our mission is to save our clients money and time to deliver a gratifying process. Most Realtors will run out to show homes before asking all the appropriate qualifying questions to discover the buyer’s true needs and wishes. Our strategy is to take the time to get to know our client’s lifestyle preferences, home criteria, favorite communities and neighborhoods, school selections, and as much as we can learn about them so we can deliver the best possible experience. Focusing on crucial desires minimizes our client’s time in searching for a home.

Our Buyer Consultation Experience

- Educate our clients on market conditions and set expectations

- Review the search and purchasing process

- Understand our client’s financial qualifications and budget considerations

- Thoroughly discover our client’s wants and needs

- Review all aspects of desired areas

- Explain the following steps

- Review documentation and agreements

- Confirm expectations and schedule the next step

We are determined to find and secure the right home for our clients. Whether the home is a new construction home or pre-owned home, we will help our clients obtain their best selection on the market or off-market. Our entire team invests as many hours as necessary to find the right home. We will network with other Realtors, contact owners directly, solicit through social media, and look under every rock to get ahead of the competing buyers. We commit and dedicate 100% of our efforts and work hard for our clients. Our loyalty to their needs is #1. We will mutually execute a Representation Disclosure and a Loyalty Agreement to retain our services and pledge our efforts to each other to achieve successful results. By doing so, it provides you peace of mind that you will have a full-time Real Estate Professional to protect your best interests in every aspect of the process, whether you select a pre-owned home or new construction. It is imperative to have representation at all times. When purchasing a new home, home builders have their own Sales Counselors to represent them and look out for their interest. Our clients are all represented, guided, and made aware of the positives and negatives of any home builder reputation, communities, tax rates, and all disclaimers that may not be evident to the consumer. We want to be there for our clients from the minute they first walk into a new home community to make sure they are not “sold” without their best interests in mind.

Understanding The Market

Buyer's Market vs. Seller's Market

The market is continually changing. We are fully experienced in all markets and know how to properly navigate any circumstance to maximize our clients’ results. We know how to win in competitive markets and negotiate on our clients’ behalf to save them thousands of dollars.

Buyer's Market

Seller's Market

Pre-Owned Homes:

When a Realtor receives a sign call from a buyer, the Listing Agent’s main objective is to sell that home and obtain the best possible price for their contracted seller. Most Listing Agents are not comfortable with, or in a position to negotiate against their own seller. Many Realtors are not experienced to handle a Dual Agency without confl ict. When we represent our buyer clients, our main objective is to protect the buyers best interest and make sure they don’t overpay or overlook what a Listing Agent could be trying to sell them. We make sure they understand each home’s positives and negatives, so they make a well-informed decision.

New Construction:

Cesi Pagano & Associates has represented many of the top new construction companies in the past and continues to work with them today. Our team is well versed in all homebuilders within the Southern California Region, their products and their neighborhoods. We work closely with these homebuilders and have insight that is invaluable to our clients.

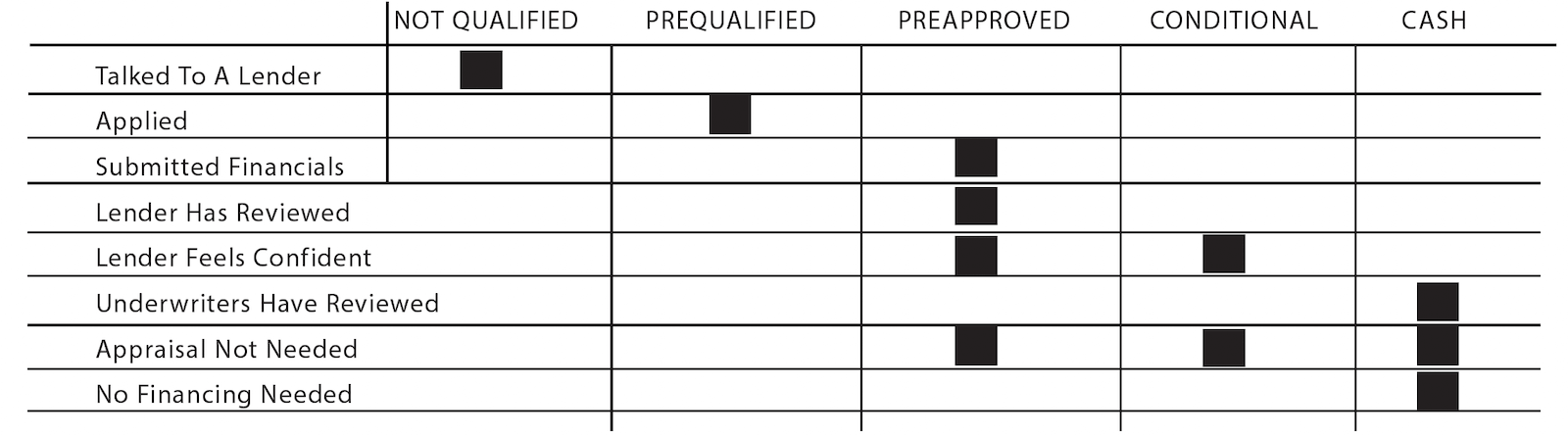

Financing & Pre-Approval

Different Levels Of Qualifications

4 Top Questions To Ask A Lender:

- Are you a broker or banker? Or both?

- What are interest rates looking like right now? Can you send me a Loan Estimate Form that shows all fees?

- What is the price range I need to stay within to get my desired payment?

- Will you have my loan documents at the escrow company three days before closing?

Don't Jeopardize Your Closing

Please make sure you don't do any of the following until after you have closed and funded on your new home

- Change jobs, become self-employed, quit a job, or retire

- Buy a car, recreational vehicle, or other large items

- Use charge/credit card excessively or let payments fall behind

- Spend money intended for closing

- Omit debts or liabilities from the loan application

- Buy furniture

- Start new lines of credit

- Change bank accounts

- Receive large amounts of money from someone without letting the lender know first

- Pay off large amounts of debt that changes your debt to income ratios

- Co-sign a loan

Home Search

There are many factors to consider when selecting a neighborhood that is right for you. Below are just a few of the many factors you may think of and could be important to you.

Define Needs For Your Home

Write down why you are looking for a new home

For example, are you currently renting and would like to buy a home to begin building equity? Maybe you recently got married and have outgrown your current residence? Or perhaps you have just been promoted, which requires you to move to a new city. These factors will all have a bearing on how you approach your home search.

Establish A Time Frame

This time frame needs to be one you can stay within for buying your home. Depending on your reasons for wanting a new home and the current state of the market in the area you are looking to buy, you should be able to come up with a rough guideline, which you can finalize at a later time.

Write Your Ideal Home Wants/Needs Down

You most likely have a mental picture of what you would like your house to look like and the features it should have. Take a moment to decide which features are “Requirements” (location, number of bedrooms, eating space, architectural style, etc.) and which features are “Extras” (fireplace, walk-in closets, pool, siding, vaulted ceilings, deck, landscaping, etc.).

There are many different features in homes that range from necessary to luxury. It is easy to get caught up in the excitement of a beautiful home loaded with amenities. You must select a home that truly meets all or most of your requirements first and foremost! As you tour homes, check back to this list to make sure the home meets your needs. The extras should only come into play when you make your final decision between homes.

Choosing The Right Neighborhood Is As Important As Choosing The Right House!

Neighborhoods have distinctive personalities designed to best suit single people, growing families, two-career couples, or retirees. Investigate to determine that the community in which you choose to look for a home matches your lifestyle and personality. There are many things to consider when selecting a neighborhood that is right for you. Below are just a few of the many factors (you may think of others) that are important to you.

Scout Out The Neighborhood!

It is essential that you scout the neighborhood in person. You live in more than your house. Talk to people who live there. Drive through the entire area at different times of the day, morning, afternoon, evening, and late at night, as well as going during the week and on weekends. Look carefully at how well other homes in the area are being maintained, painted, yards well cared for, parked cars in good condition, etc.

Neighborhood Factors To Consider

Look for things like access to major thoroughfares, highways, and shopping. Listen for noise created by commerce, roads, railways, public areas, schools, etc. Smell the air for adjacent businesses or agriculture. Check with local civic, police, fire, and school officials to find information about the area—research things like soil and water. Look at traffic patterns around the community during different times of the day and drive from the area to work. Is the neighborhood near parks, churches, recreation centers, shopping, theaters, restaurants, public transportation, schools, etc.? Does the neighborhood belong to a Homeowner’s Association?

Now that you have your list of needs and wants and know how much you can afford to spend, it’s time to look at some houses! Not just yet...

Get Local Neighborhood Information

Step back for a moment and consider the larger picture. People don’t just buy a house; they buy the neighborhood the house is in. Think about that... If you found the perfect home, but it was in a setting that wasn’t to your liking, would you make an offer on it? Most likely, the answer would be “No.”

So, you will need to make another *list of what type of neighborhood you want to live in. You will most likely want to consider things like how living in this neighborhood will affect your drive time to and from work, what amenities are offered (swimming pool, tennis courts, park, etc.), and, if you have children, which school district you will be in and how close the schools are. You may even want to make two lists just as you did with your home criteria.

Cesi Pagano & Associates can help you consolidate the information from your list of needs and wants for your home, your pre-approval, and your list of neighborhood requirements and wants. From this, you can incorporate this information into a broad search profile, which will then be narrowed down to specific areas dictated by the market in which you will be looking. Our experience in local markets will be an invaluable resource during this step.

Recommendation - write these on your Requirements List, so they are not forgotten.

Writing The Offer

If finding a home is the fun part, then writing the offer is when things start to get really exciting! Though there are more challenges in this stage of the process, you are one step closer to owning your home. Anyone can find a home they love, but Cesi Pagano & Associates can help you write a competitive offer and get through the occasional choppy waters from the time you go under contract to when you get the keys.

Choosing The Offer Price:

The right price fairly reflects the market value of the home you want to buy. To find this price, your agent will provide you a Comparative Market Analysis (CMA), a set of records about recently sold homes that resemble the one you want in size, condition, location, and amenities.

Key Negotiation Terms

- Price, Down Payment, Deposit

- Multiple Contingency Time-Frames

- Allocation of Costs

- Repairs

- Possession Date

- Close of Escrow

Multiple Offers

We will ensure that you have everything in written form, NO verbal agreements. After we prepare a written contract that meets all the legal requirements according to local, state, and national guidelines, we will present the seller with a written document detailing the offer’s terms. This contract protects the best interests of all parties involved and is a comprehensive, legal document approved by the California Association of Realtors. We will also safeguard your financial position as the buyer by including any necessary contingencies, which will protect you if the seller does not perform according to the terms. We want to keep in mind that it may be too late to make any changes once the seller accepts these terms.

The Contract, Though Not Limited To This List, Shall Include The Following:

- Property Address

- Offer Price

- Amount of the Earnest Money Deposit

- Down Payment

- Financing Arrangements

- Buy furniture

- List of Fees and Costs, Broken Down By Who Will Pay Them

- Inspection Contingency

- Appraisal and Loan Contingency (if required)

- List of Appliances and Furnishings That Stay with the Home

- Settlement Date

- Name of Escrow and Title Companies

Remember that the legalities of this phase are essential. If you have any questions or concerns, they need to be addressed right away. After all, no one has ever said at their closing, “I wish I had asked fewer questions.”

The Offer, Negotiations, Counters & Acceptance

What To Expect When An Offer Is Presented

Accept: The seller may accept as is.

Decline: The seller does not accept the offer and does not wish to counter (not usually recommended as the offer can generally be negotiated and often ends up at an acceptable medium).

Counter: The seller may counter the price you offered, or may only counter the terms they don’t agree to and wish to change.

Negotiations Continue: If the price or terms countered by the seller are not acceptable to you, we may continue negotiations and counter again until all terms are agreed upon.

Offer accepted and executed: Once both parties mutually agree to all terms, we may open escrow and begin the purchase process.

Note on Privacy & Security: Please note that internet fraud is on the rise. Please do not take action on any requests received by any party unless consulted with us, your Realtors. We will guide you on the best way to protect your privacy and security.

The Offer, Negotiations, Counters & Acceptance

When you are ready to submit an offer on your potential home, we will do the following:

- Review the offer with you personally.

- Go over every item in the contract with you to thoroughly understand what you are offering and what you should be asking for.

- Present your offer to the seller and negotiate the best possible price for you.

- Give you as much input as we possibly can regarding: Current market and finance activity, Other sales to date, Competition and Broker comments

Negotiation Of Offers & Sale

Once your offer is made, we may need to enter some negotiation to reach an agreement. Keep in mind that almost everything is negotiable when you are buying a home. This can give you a great deal of leverage in the buying process; that is, if you have adequate information and use it appropriately. As your real estate consultant, we will have the market knowledge and negotiating expertise necessary to ensure that your offer is accepted at the best price and terms possible for you.

Some Of The Things That May Need To Be Negotiated Are:

- The Price

- Financing

- Closing Costs

- Repairs Needing to Be Done

- Appliances and Fixtures

- Landscaping

- Painting

- Occupancy Time Frame

When purchase contracts are negotiated, you will be kept informed every step of the way.

During The Buying Experience, We Will:

- Establish and explain guidelines prior to presentation.

- Present your offer as quickly as possible.

- Review the contract with you.

- Keep you up-to-date on current market activity, which may affect your offer strength.

- Ensure that all parties in all transactions are treated fairly and with honest consideration

- Make certain there is compliance with disclosure laws and ordinances.

The key to successful negotiating is understanding that the end result must make both you, the buyer, and the seller happy. Otherwise, negative feelings will persist throughout the process, and someone may walk away, feeling that they were not treated fairly.

Escrow

What Is Escrow?

Escrow is the depositing of funds and documents that establish terms and conditions for the transfer of property ownership with an impartial third party. When the parties deliver documents and money to the impartial escrow holder to be held for further delivery until certain conditions have been met, we say the documents are held “in escrow.” We may also say the parties have “opened an escrow.” Each of the principals of the escrow (Seller, Buyer, Lender) will give to the escrow holder written instructions setting out the conditions under which the further delivery is to be made.

The Purpose Of An Escrow:

- The common use of an escrow is to enable the parties in a real estate transaction to deal with each other with less risk since the escrow holder acts as the following:

- Custodian for funds and documents

- A clearinghouse for payment of all demands

- An agency to perform the clerical details for the settlement of the accounts between the parties

Typical Escrow Transactions

An escrow begins with the real estate agent opening the order for title work’ and provide the Purchase Agreement and all executed documentation to escrow. Once received, a Title company prepares a preliminary report. Upon receipt of this report, the analysis is made to determine the necessary action and documents required to complete the transaction.

- Demands for the satisfaction of liens not acceptable to Buyer and/or Lender

- Documents for recording

- Instructions and requirements of the new lender

Escrow is now open. The escrow length is determined on the fully executed contract between you, the buyer, and the seller. During this time, it is essential you are in touch with your lender to review loan programs, provide them with all necessary documentation to process your loan successfully. Please be sure to ask your lender for a complete Good Faith Estimate. This will allow you to review all anticipated closing costs due at the close of escrow, such as points on the loan, escrow fees, title fees, processing fees, impound fees (if applicable), and all other miscellaneous fees. On this day, we will also begin contacting your selected inspectors to schedule your new home inspection.

The inspection should be scheduled within the first week after acceptance of your offer. This will allow you to have enough time to review all inspection reports, get second opinions (if applicable), and still have time to request repairs to the seller, all prior to your removal of the contingency deadline.

Contingency Periods Begin, Inspections, Appraisal & Loans

Inspectors are not superheroes; they cannot see through the walls or predict the future. They can spend several hours combing over the home to identify what they can that’s currently wrong or out of code on the home.

Cesi Pagano & Associates will work with you to prioritize the essential items and go for negotiating those times. These inspections must be done during the period, so you should schedule it within the first 48 hours after your offer is accepted. It is essential to keep in mind that California homes are sold as-is; in their present condition. All buyers are advised to conduct their investigations to precisely determine the home’s present condition.

Various Reports To Be Reviewed During The Contingency Period:

- HOA Documents

- Local Area Disclosures

- Sales Disclosures

Is An Inspection Necessary?

You have the right to request an inspection of any property you are thinking of purchasing by a professional inspector of your choice. You should always exercise your option to have the physical condition of the property and its inclusions inspected. Many more severe and expensive problems, such as mechanical, electrical, structural, and plumbing, are not noticeable to the untrained eye. If repairs are needed, negotiate these in your contract offer. A professionally conducted home inspection followed by a written evaluation is becoming standard procedure in home buying because of increased buyer awareness and savvy.

Beware Of False Claims

Consumers must be cautious in evaluating some of the claims made by people hoping to fill the growing demand for home inspection services. Many new companies request only an application fee. Some claim to offer certification but do not require exams or proven credentials. Still, others boast engineering licenses as an assurance of competence, even though the engineering license has nothing to do with home inspecting.

What Does An Inspection Entail

A qualified inspector will follow the Standards of Practice in conducting their inspection. The inspection consists of a physical examination of the home with the purchaser present, followed by a written report detailing their findings. They report on the general condition of the home’s electrical, heating, and air systems, interior plumbing, roof, visible insulation, walls, ceilings, floors, windows, doors, foundation, and visible structure. The inspection is not designed to criticize every minor problem or defect in the home. No home is perfect. It is intended to report on significant damage or serious problems that require repair for the well being of the home, requiring considerable expense.

Buyer Education Is Necessary

The primary purpose of the inspection is to educate the buyer to make an informed purchasing decision. The inspector should allow and even encourage the buyer to attend the home inspection. A good home inspector knows how the home’s many systems and components work together and minimize the damaging effects of sun and water. The buyer’s attendance at the inspection provides them with an overall idea of possible future repair costs and maintenance routines. This is valuable information, which could increase the life span and perhaps the home’s future selling price.

Time And Fee Guidelines For The Inspection

The time necessary to properly inspect a home and the fee charged by an inspector vary according to market location, the home’s size and age, and the individual inspection company. However, you can expect that it will take an average of two to three hours to competently inspect. Your Realtor® may not be at the inspection, so notify your Buyers Agent after completing the inspection.

Home Inspection Is Completed

After the home inspection has been completed and we have received your inspection report, we will review it with you. Together we will check all items of concern to request repairs from the seller by submitting a written “Request for Repairs.” Note that all these items are negotiable. Once you and the seller have a mutual agreement, we will proceed with the purchase process. At this time, we will be reviewing all disclosures and researching/investigating all necessary matters affecting your home.

Removal Of Contingencies

Your lender has now provided you with a formal loan approval. This means all lender requirements and conditions are met and finalized. You’ve reviewed and approved all disclosures, reports, and other applicable information pertaining to this home. At this point, the seller will now require you to remove these contingencies. This means that you agree not to add any additional conditions to your purchase. Upon signing your Contingency Removal, your deposit becomes non-refundable.

Processing The Sale

A Real Estate Consultant has more responsibilities than showing! Check list for processing your purchase:

- Contact the escrow company to notify them of the sale and make sure they have all the necessary copies of all signed and applicable documents.

- Deliver Earnest Money Contract and check to the Title Company.

- Obtain a receipt for earnest money check from the Title Company.

- Notify your lender of your purchase and make sure they have all the necessary copies of all signed and applicable documents.

- Order all the required inspections.

- Examine the Title Commitment for clouds and make sure problems are disclosed early, so closing is not delayed.

- Ensure that you receive copies of all documentation pertinent to the transaction.

- Note all contingencies and attempt to remove them within the time limit provided or get n extension of time, if needed.

- Keep you abreast of your loan process & the progress of the appraisal on your new home.

- Be present during inspections and keep you informed of their findings: (Roof, Pest Control, Pool, Building, Plumbing & Heating).

- Confirm any required termite treatment and make sure the certificate is obtained.

- Coordinate the execution of any required repairs.

- Verify the survey has been ordered and completed.

- Provide Title Company with any charges for HUDl.

- Have closing papers drawn before closing so that if any problems arise, we can solve them.

- Coordinate the closing and move-in dates so that they are as convenient to both parties as possible.

Home & Title Insurance

Title Insurance

Protects the holder from financial loss sustained from defects in a title to a property. The most common claims filed against a title are back taxes missed by a title company, liens (from mortgage loans, home equity lines of credit, easements), and conflicting wills.

Home Insurance

During the inspection contingency period, it’s crucial to confirm insurability with the home. You’ll want to shop around with several companies as your lender will need proof of insurance before final loan approval.

Find The Vendors You Need

After your offer has been accepted, we will supervise all necessary vendors’ coordination and serve as your advocate when working with each vendor. Your agent will ensure that the vendors have access to the property at the appropriate times to perform their procedures and oversee the execution of those procedures on your behalf.

For instance, the property will need a thorough examination. Working with your lender, you may need to have a formal appraisal and a survey done for the property designated in the contract. A property inspection, a foundation inspection, and an environmental inspection may also need to be completed to ensure that the property meets the standards outlined in your written agreement. If there are issues or inconsistencies brought to light during this time, it may delay or even nullify the contract depending on the contingencies outlined in the contract.

Homeowner insurance is another essential item that will need to be taken care of at this point. Insurance experts recommend that you obtain insurance equal to the full replacement value of the home. Unless you have insurance coverage on the home, the closing can not proceed. Having these procedures done in a timely and professional manner is a must. Investigate each vendor to make sure that they are reputable and have a clean operational history.

Your agent’s experience in this area will be invaluable, ensuring that everything is completed on time and professionally and legally.

Choosing A Home Warranty

The number of homeowners who purchase a home warranty protection plan has gone up over the years. Home warranties can cover or discount repairs on the home’s major components, such as washer, dryer, and water heater. The seller will often include a home warranty as part of their negotiation process, but even if the seller does not agree to pay for it, you can purchase one yourself. Warranty companies have agreements with local companies, so when you file a claim, they send out one of their service companies to handle repairs. The cost to you generally is just the price of the service call and any additional service that may not have been covered by the warranty. You’ll have the option of renewing your service contract every year. Keep in mind that a home warranty may not cover everything, and some claims may be denied. If the item hasn’t been properly maintained, the claim can be rejected. If you decide to move forward with the repair, you’d then be expected to cover the cost. A home warranty’s benefits can be huge, especially for homeowners who don’t keep an emergency fund or would like not to use up their entire emergency fund on one repair. Unforeseen repairs show up at the worst times, and a home warranty can help cover the cost of those repairs or replacements.

New Home Warranties

When you purchase a newly built home, the builder usually offers some sort of full or limited warranty on things such as the quality of design, materials, and workmanship. These warranties are generally for one year from the purchase of the home. At closing, the builder will assign the manufacturer’s warranties to the builder for materials, appliances, fixtures, etc. For example, if your dishwasher were to become faulty within one year from the purchase of your newly built home, you would call the dishwasher manufacturer - not the builder. If the homebuilder does not offer a warranty, BE SURE TO ASK WHY!

Resale Home Warranties

When you purchase a resale home, you can buy warranties that will protect you against most ordinary flaws and breakdowns for at least the first year of occupancy. The seller may offer the warranty as part of his overall package or by some Realtors® who have access to programs that will ensure the buyer against any home defects. Even with a warranty, you should have the home carefully inspected before you purchase it. A home warranty program will give you peace of mind, knowing that the important covered components in your home will be repaired if necessary. Ask us for more details about home warranty packages.

Pre-Closing Process

Signing of Documents

Upon your loan approval, your lender will order your loan documents. These loan documents are primarily your commitment to the loan program with your lender. Traditionally, these loan papers are signed with your escrow officer along with other closing documents such as your Grant Deed, etc. Your lender will forward these documents to the escrow company, and it takes approximately 2-4 days to be delivered, depending on the lender. Upon receipt, your escrow officer will calculate all your costs and contact you to set up an appointment. At this time, your escrow officer will provide you with the total amount of funds required to close escrow. These funds must be in the form of a cashiers check drawn on a California bank. Should you wish to wire your funds instead, please contact your escrow officer for wiring instructions. As a reminder, you will need to provide proof of property insurance on your new residence. Your lender will not fund your loan unless your homeowner’s insurance policy is in place. Should you decide to have an impound account, please review this option with your lender.

Impound Account

An impound account is a neutral depository for funds used to pay expenses incurred by the property, such as taxes, assessments, property insurance, or mortgage insurance premiums, which fall due in the future. You will pay one-twelfth of the annual amount of these bills each month with your regular mortgage payment. When the bills fall due, they are paid by the lender from the special account. At closing, it may be necessary to pay enough into the account to cover these amounts for several months so that funds will be available to pay the bills as they fall due. You may also be required to refund items prepaid by the Seller. For example, if the Seller has paid the special assessments or taxes for that year, you may be required to refund the value of the months remaining in the year when you take possession of the property. An escrow fee is usually charged to set up the account.

Utilities

You will receive a list of utility companies to assist you in coordinating service for your new home. Utility companies can require up to seven days to connect gas, electricity, water, phone, and cable. Please make an application with the utility companies at least seven days prior to your moving date. (Note: Please do not transfer service to your name until after your closing date.) Be sure to notify your Post Office for a change of address, the DMV, your creditors, etc.

Loan Funding & Recording

After you have signed your final documents at escrow and have turned in all your funds, your documents are forwarded back to your lender for review. Your lender will then verify that your home is completed and all required governmental inspections have passed.

Upon confirmation, your lender will fund the loan and authorize escrow to record the Deed with the County through the Title Company. It usually takes approximately three to five days to Record Title into your name from when your documents are delivered to the lender, and the authorization process occurs. Once the Grant Deed has officially recorded, you have closed escrow!

Closing Escrow & Moving In

Final Walk-Thorugh

We will now schedule a walk-through at your new home. During this walk-through, we will confirm that all mutually agreed-upon repairs have been completed. We will also ensure that the home is still in the same condition as when you initially purchased it.

Receipt Of Keys

When the transfer of Title has been confirmed by the escrow officer, who informs us, we will notify you and make the necessary arrangements to give your keys to you!

Moving

We have discounts available for certain movers and are happy to send names of companies to you. If you need assistance packing, we have those resources as well. Now that you have taken ownership of the property, you will need to have your local services such as electricity, cable, and phone set up. Also, you should already be aware of the expenses that are typically associated with owning a home. Neighborhood Association fees, landscaping costs, supplemental property tax, and annual taxes should be budgeted throughout the year.

Cleaning

You want to have the home cleaned before you start moving and unpacking. It won’t be empty again until you go to sell! Let us know if you need a list of house cleaners to help.